Google Think Auto 2019: The Automotive Industry is Ripe for Disruption

It’s no secret that the automotive industry is encountering disruption, but how fast are new changes heading our way? Al-Karim Awadia, Head of Industry – Auto at Google Canada shared several key insights into future disruption during Google ThinkAuto 2019.

Starting off with the industry headwinds, Awadia pointed out that the automotive industry is currently at its tipping point. Retail, financial, telecom, tourism and media industries have already gone through the pains of disruption.

According to a McKinsey report quoted by Awadia, a tipping point is reached when digital revenue exceeds 40% of the total revenue and the digital advertising budgets increase even as new – often cross-industry – alliances are formed. Tesla, Ford & Genesis are already going the eCommerce way.

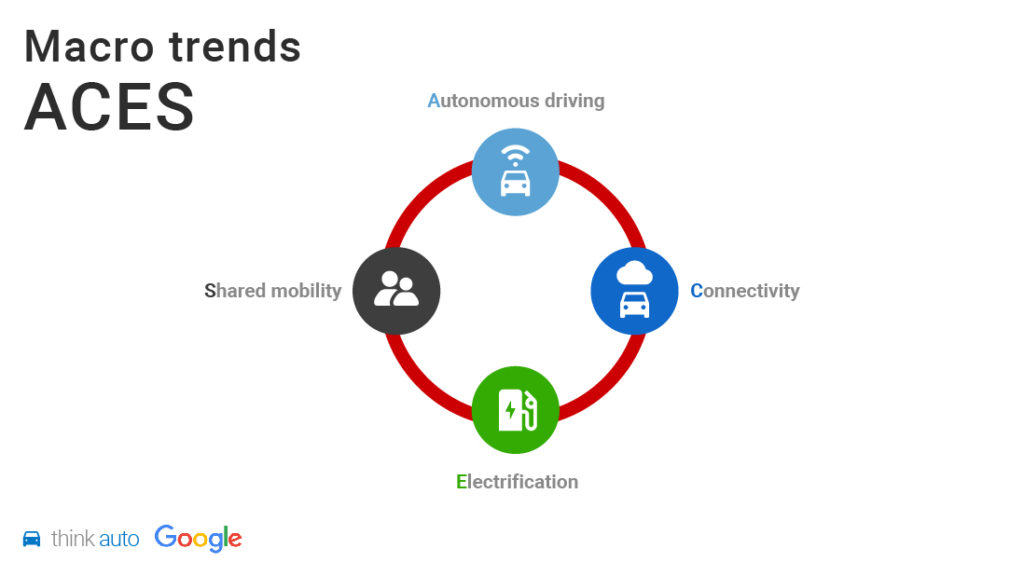

“This industry will change faster in the next five years than it has ever before. The four main disruptions moving this industry today, according to Awadia, are: Autonomous driving, Connectivity, Electrification and Shared mobility, or ACES in short,†he noted.

Relieving people from the driver seat could open up whole new industries. With the help of 5G networks, the number of connected vehicles would go up to 5% by 2025 and 15% by 2030. Auto companies can become data companies in the future.

According to Awadia, this would not only help the autonomous driving cars become more mainstream but also impact the car diagnostics and insurance industries as the ‘pay how you drive’ insurance will become a reality.

“Canada has set a target of 10% of all vehicles to be zero emission vehicles by 2025 and 100% by 2040. OEMs like Toyota are setting ambitious targets of dominating half the electric vehicles’ market by 2025. Carpooling, urban mobility and car sharing apps have already started showing their impact and this is only bound to increase in coming years,†he added.

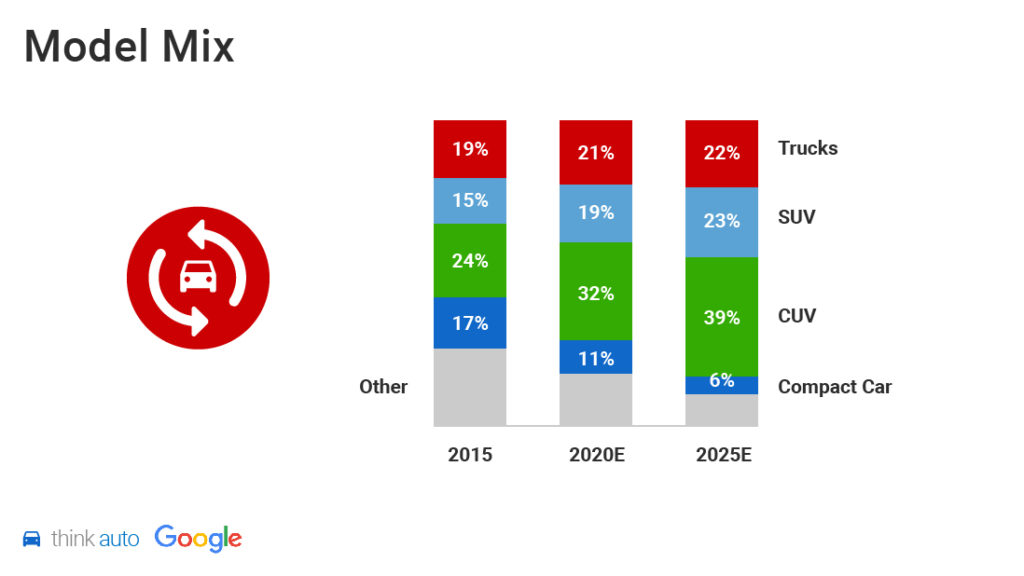

Another key trend Awadia shared at the event was how the model mix was changing towards sport utility vehicles (SUVs) and compact utility vehicles (CUVs) in Canada. The share of compact cars is expected to decrease from 17% in 2015 to 11% in 2020 and to a mere 6% in 2025.

On the other hand, the largest positive change will be in the share of CUVs, which is expected to go up from 24% in 2015 to 32% in 2020 and 39% in 2025. SUVs and trucks will go up as well while all other models will reduce to a negligible share in the overall model mix.

“There will be 63 launches per year in the CUV and SUV categories and OEMs would no longer like to please everyone. OEMs are now moving towards long-term profitability from the days of dominating market share. Niche is okay now.

Dealer consolidation will continue to happen across Canada as sales at dealer groups (DGs) have gone up to 70% today from 25% three years ago. They will control the car purchase journey and cater to buyers’ life stages. OEMs would, therefore, need to influence DGs more, going forward,†said Awadia.

Do you want to identify the right opportunities to influence sales around car buyers’ life stages? Learn how TRFFK can help you establish the right digital strategies!

— Sparsh Sharma – Digital Strategist, TRFFK