‘Digital retailing could very soon become a big deciding factor between two similar dealerships’

The year 2020 will go down in history as one that presented unprecedented challenges on multiple fronts for the automobile industry – affecting all three tiers. As we enter 2021 in various degrees of lockdown, a pandemic-weary industry is looking forward to the days when business can go on as usual.

Business will not go back to being exactly how it was in the pre-pandemic days. But if history has taught human race anything, it is resilience and hope. There is always a silver lining to focus on. Benoit LaForce – General Manager, TRFFK, shares his views on the key digital and consumer trends that will most likely redefine the post-pandemic business landscape in a tête-à -tête with Sparsh Sharma.

SS: What will be some of the biggest and most redefining trends in 2021 and beyond?

BL: Last year presented us with several challenges indeed but as Albert Einstein said, “in the middle of adversity there is great opportunityâ€. Some of our dealer clients smartly realized this and evolved their ways of doing business. The biggest opportunity for dealers was on the digital retailing side.

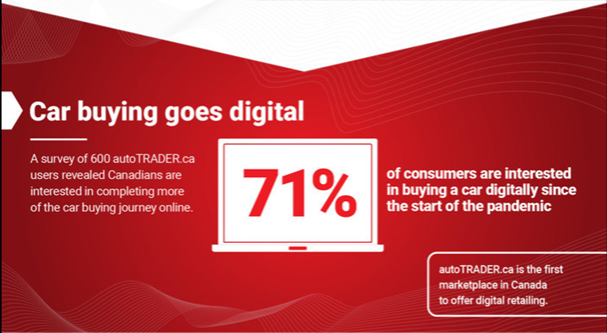

In fact, digital retailing could very soon become a big deciding factor between two similar dealerships. The latest autoTRADER.ca user survey revealed that 71% of Canadian consumers are interested in buying a car digitally since the start of the pandemic.

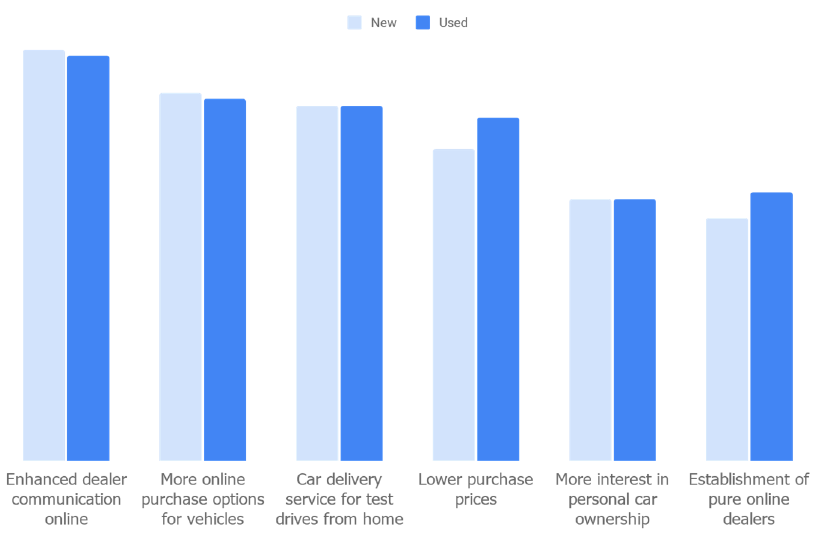

Recent automobile industry data shared by Google shows how vehicle searches in Canada remained higher YoY than average throughout much of last year. At the same time, new and used buyers have nearly the same expectations for how COVID-19 will reshape car sales – with enhanced dealer communication online and more online purchase options topping the list.

Information is power and given the proliferation of vehicle review videos available online these days, buyers are being more open to new choices by considering over twice as many vehicle segments as they did before. But due in some part to the ongoing physical restrictions, dealers only have one shot at converting these in-store visits.

SS: You are right. Information, generally, and review channels online have been gaining more trust and eyeballs in recent times. The depth of reviews too has gone up over the years. I remember relying heavily on them before finalizing my vehicle purchase. What can dealers do to use this medium more effectively?

BL: Online videos help move buyers down the funnel and 72% of those who watched an online video completed at least one follow-up action. Google’s recent data confirms this and this trend is even more pronounced among first time car buyers.

Actions taken after watching an online video included visiting a dealer website, locate a dealer, use a car configurator to build and price a vehicle, scheduling a test drive, requesting a price quote, and researching financing or leasing offers online.

Most of TRFFK’s dealer clients who tested YouTube videos saw amazing success. Walkthrough videos of the dealership, promoting dealership’s USP, reviewing top models or even promoting offers are some of the themes that can work well for a dealer – that help generating traction with its audience.The creative quality and resonance, however, are very important. And then there are other equally important factors for success like up-to-date inventory, remote selling and payment options for down payments and other charges, conveying the safety and delivery options to potential buyers and enhancing the overall online car shopping experience.

SS: Absolutely. You touched upon first time car buyers. Given that recommended physical distancing measures are here to stay for another year or more, do you think more transit-dependent urbanites may start buying cars & driving to work?

BL: Yes, another autoTRADER.ca study completed in October 2020 revealed decreased confidence in public transportation and ridesharing, prompting an increased desire for vehicle ownership. It mentioned that 65% of Canadians did not plan on using ridesharing after the pandemic and 54% of riders said they did not plan on using public transit after the pandemic.

Similar trends have been witnessed in the US too. According to a news article in the Financial Times, Volvo’s sales in China were up 20% YoY in April 2020 – in part due to health concerns – while the whole market was 4.4% higher than a year earlier. The same FT article quoted a UK survey by autoTRADER that found more than half of UK driving license holders without a car considering buying one after the lockdown.

Another news article ran by BNN Bloomberg in May 2020 quoted how Apple Maps data for 27 other cities globally showed driving directions recovering more quickly than directions for mass transit. In Ottawa, driving directions had recovered to 40% of normal levels compared to directions for mass transit at 80% below normal levels.

These are net new car buyers that were previously resistant to car ownership and according to data from autoTRADER.ca as well as from many of our dealer clients, have been gravitating more towards preowned vehicles. Noteworthy here is that their expectations from dealers remain very high. This is even more reason why dealers need to advertise used inventory online and care about online merchandising as well as communication.

SS: Given the inventory challenges, especially on the used side of dealer operations, how will this extra demand be fulfilled? And which vehicle types will be more popular?

BL: Dealers across the country have been struggling with inventory, especially from September 2020 and particularly on the used side. Reduced capacity at auction houses, lower volumes of trade-ins and off-lease vehicles as well as US dealer interest in Canadian inventory have resulted in scarcity of used vehicles pushing used car prices up.

We have advised Trader and TRFFK’s dealer clients, particularly those facing this challenge, to focus more budget on trade-in campaigns and this strategy – coupled with a few other customized solutions – has been working wonders.

On the new side, factory closures during early 2020 coupled with low financing rates through much of last year led to lower inventory. There is an ongoing shortage of new pickup trucks that has driven prices up in this segment. Desrosiers January new car sales numbers estimate that the light truck share for the month stood at ~85%, smashing through the 80% threshold as SUVs and pick-ups continued to make relative market gains at the expense of passenger cars.

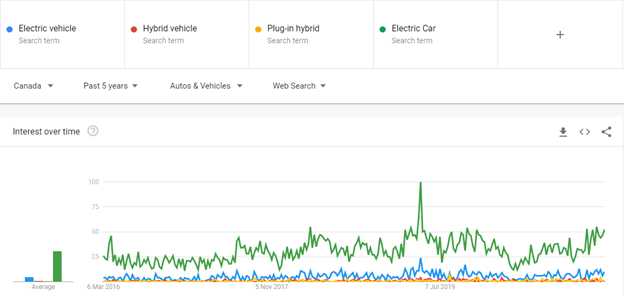

autoTRADER.ca data shows that more consumers are opting for vehicles equipped with all-wheel drive capabilities and raised seating leading to the discontinuation of several models in the economic subcompact category by many automakers. Our data also indicates national searches for electric and hybrid fuel types increased 19 per cent year-over-year. Looking at the Google Trends over the last five years at a regional level reveals that British Columbia, with its rebates on electric and hybrid vehicles, saw the most interest in them. Interest in electric and hybrid cars grew steadily but peaked around the time BC bought in legislation in 2019 that gives rebates to green car buyers.

TRFFK’s dealer-clients did see surging interest in the electrics and hybrids from early 2019. A lot of that interest also turned into actual sales across BC, peaking in the summer, and sustaining through the rest of 2019. It is forced many dealerships to focus on their inventory of electric and hybrid vehicles. BC is surely leading this trend in Canada and it will be interesting to watch this space in other provinces like Quebec & Nova Scotia that have announced rebates on electric cars.

SS: Any other tips for our dealer-clients in the context of digital marketing and advertising?

BL: We are not fully out of the woods yet and there is still some uncertainty on how strongly the next few months will shape up. This is where dealerships have an essential part to play, and working with their trusted vendors, need to ensure the website and digital assets as well as campaigns currently in market are vetted from time to time to reflect local realities and are in good taste. For e.g., you can focus on your digital retail offering instead of asking the customer to come in for a test drive or offer car buyers air miles instead of free air trips during this time.

— Sparsh Sharma – Digital Strategist Manager, TRFFK