Emergence of SUVs and Trucks as Growth Drivers for Vehicle Sales

For many dealers across Canada, 2018 was a banner year in terms of new car sales. In comparison to 2018, then, 2019 data may look disappointing, as new car sales were down 3.6% YoY. Want a slight silver lining? 2019 was actually better for new car sales than 2017 – while we’ve experienced a dip in 2019, we’re primed for another “2018” for new car sales in 2020 if we can properly read the tea leaves. So, what did we learn from 2019?

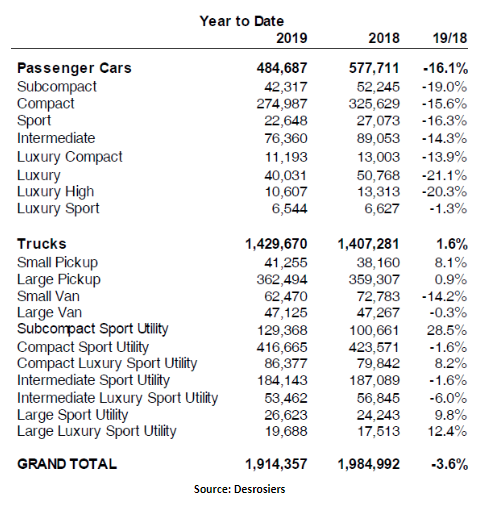

A major drop in sales observed in the first half of 2019 was covered by more optimistic numbers seen in the second half of the year. Most notably, SUVs and trucks emerged as growth drivers for new vehicle sales, even as passenger cars saw negative growth.

“Pickup trucks and SUVs swallowed more market share from passenger cars – a segment with subcompact and compact cars among others. Most of our dealer clients were already aware of how SUVs and trucks were becoming the new favorites, but the 2019 data has now helped validate the picture for all of Canada,†says Benoit LaForce, General Manager of TRFFK.

What this means for dealers is that they need to focus on restructuring their inventory mix for 2020 and include more small and large pickups as well as subcompact and large SUVs. The biggest gains in terms of YoY sales was in the category of subcompact SUVs followed by small pickup trucks and large SUVs. On the other hand, the biggest YoY declines were for subcompact cars followed by both sport and compact cars. In the luxury sub-segment, the large SUV sub-category saw the highest YoY gains followed by the compact SUV sub-category. The biggest shifts the other way were in the luxury and luxury-high passenger cars sub-categories.Â

What does this mean for a dealership’s 2020 digital advertising strategy?

While last year was all about realizing the changing dynamics of new car buyers’ behaviors and preferences, the message for dealers is loud and clear in 2020: Devise digital strategies that perform the best for your inventory mix and maximize your efforts on your bestsellers.

Showing relevant make and model ads that bring traffic to a dealer’s website during the active ‘awareness’ and ‘consideration’ phases of a car buyer’s journey is paramount to sales success in today’s ‘connected world’ with blurred physical and digital boundaries. Moreover, studies have suggested that dealers with more personalized ad experiences lead car buyers to place more trust in that dealer.

“In 2019, some dealers frustrated with slower sales chose to go ‘dark’ on the internet – thinking that their digital advertising is not doing its job because of slowing sales” says Raman Gill, Senior Sales Manager at TRFFK. “Taking this path is fraught with risks and ends up hurting the bottom line much more than, say, lowering budgets in tougher times and focusing on the most-relevant digital channels. Having an online presence at all times is a ‘must-have’ now; not something that’s optional and first to get its budget axed. The old ways are no longer going to work as well as they have in the past.”

The biggest take-away for dealers as we enter 2020 would be to work on a digital strategy unique to their circumstances instead of getting frustrated with slower car sales and abruptly deciding to cut the entire digital advertising spend altogether. Modern marketing wisdom dictates that a good marketing strategy should be rooted in consumer insight. And there’s no better medium than digital to accumulate buyer insights and create an agile digital strategy, which would be the key differentiator for dealers in the new year and decade.

– Sparsh Sharma – Digital Strategist Manager, TRFFK